Nilanjan Banik

I.INTRODUCTION

WHY THIS PAPER?

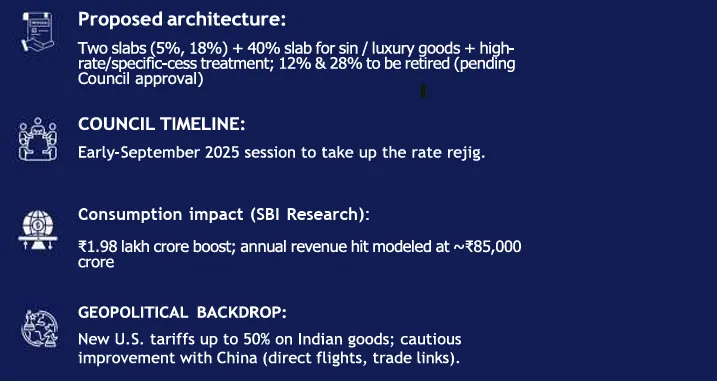

India’s proposed GST 2.0 is being framed as the biggest reform to the indirect tax system since 2017: India’s upcoming GST 2.0 announcement, slated for implementation by Diwali, is being widely promoted in the media as a “Diwali gift”—a measure to reduce burdens on everyday consumers. Prime Minister Modi’s Independence Day speech has already prompted headlines calling it “a brighter gift of simpler taxes” and a “gamechanger” for GST. 1|2|3

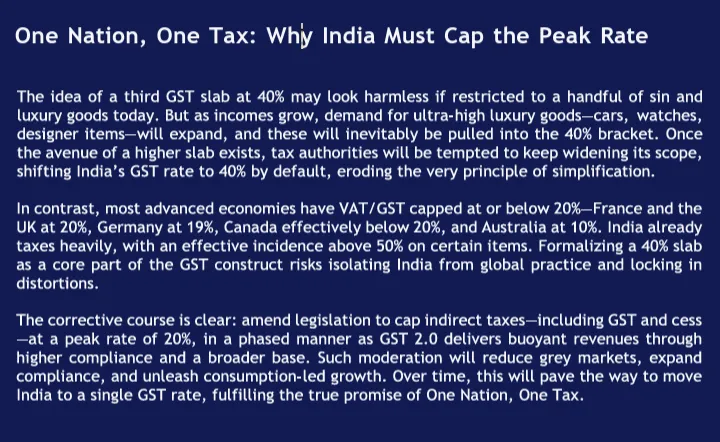

Media reports indicate that the reform architecture may not stop at two slabs. Instead, a third slab at 40% for sin and luxury goods—such as tobacco, pan masala, luxury vehicles, and online gaming—has emerged as a key proposal, even though the government has yet to explicitly frame the reform in terms of revenue neutrality.

Instead, the narrative remains focused on the symbolic “festival gift” aspect, with little public detail on how state finances will be protected.4

This paper explores whether GST 2.0—amid external trade headwinds and strong political symbolism—can deliver meaningful simplification, uplift consumption, and preserve fiscal integrity, or whether it risks replicating structural complexity under a festive banner.

II. HISTORICAL PERSPECTIVE WHAT WAS THE VISION WHEN GST WAS FIRST INTRODUCED?

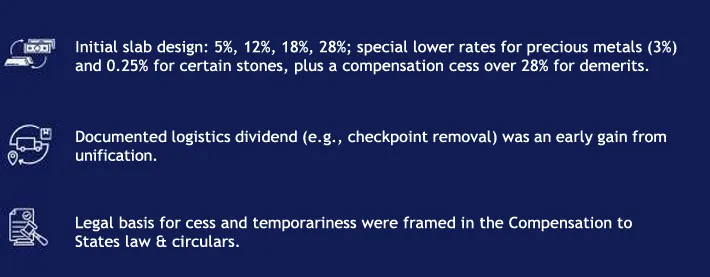

When GST launched in July 2017, India sought to replace a patchwork of central and state levies with a destination-based value-added tax that would minimize cascading, stabilize rates, improve logistics, and raise compliance. The legislative design included multiple slabs (5%, 12%, 18%, 28%) to reflect India’s socio-economic diversity, plus a compensation cess on specified luxury/demerit goods to protect state revenues during transition. The promise was a common market with fewer frictions and predictable tax incidence.10

Notably, the cess was envisaged as temporary—its remit: compensate states for revenue shortfalls in the first five years of GST. That clock has been extended in practice to enable repayment of borrowings raised during the pandemic shortfall years.11

III. CURRENT SITUATION

DID WE DELIVER ON THE ORIGINAL VISION OF A SIMPLIFIED, NATIONWIDE SYSTEM OF TAXATION?

Eight years on, complexity persists. Four slabs, frequent classification disputes, and a substantial overlay of compensation cess (especially on autos and tobacco) have kept effective rates high in several categories and compliance friction alive for businesses. Independent reporting routinely characterizes the system as complex, while the very existence of cess has required continuous updates/clarifications to resolve category-specific ambiguities (e.g., SUVs).14|15

On the macro side, GST has delivered buoyancy, but the system has not yet become the simple, lowfriction, low-dispute VAT originally envisioned. The need to extend compensation cess collections to 31 March 2026 underscores the fragility of state finances under the current configuration. 14|15

IV. NEED FOR A RELOOK

THE SUNSET OF GST CESS, AND AN OPPORTUNITY TO OVERHAUL THE TAX

The cess sunset (now 31 March 2026) creates a policy window to rationalize rates while devising a transparent, narrow, and targeted approach for exceptional items. In the present structure, too many slabs and ad hoc cess generate disputes, working-capital strain (via refunds), and uncertainty. The Center–State compact also needs a durable formula that shields state revenues without constantly extending “temporary” levies.12

GST 2.0 proposes to retire 12% and 28% slabs, migrate most items respectively into 5% and 18%, and keep special treatment only for a small set of sin/luxury goods—through a single high rate (proposed at 40%) and with specific cess so that complexity is contained and state revenue is protected. The heavy lifting now lies in clarifying where a “high rate” stops and where a specific cess starts, and how indexation works over time.12

V. GREAT VISION, BUT NEED CAREFUL DETAILING

The vision to simplify and support the common citizen is unmistakable: push mass-consumption items into the 5% slab, compress the standard rate to 18%, and rationalize anomalies (e.g., duty inversions, confusing rate differentials). But global headwinds complicate the calculus: U.S. tariffs up to 50% raise cost pressures and import-substitution debates; India’s cautious re-engagement with China could simultaneously ease input costs and create competitive pressures. Tax policy is not made in a vacuum: rate shocks—even when well-intentioned—can ripple through supply chains already under external stress.18

For the vision to translate into outcomes, transparency and predictability must guide: (i) clear mapping of what goes to 5% vs. 18%, (ii) tight containment of any high rate/cess to truly exceptional items, (iii) explicit guardrails to avoid backdoor instruments to recover the shortfall (e.g., removing ITC on zero-rated outcomes) and (iv) time-bound impact reviews so unintended effects can be corrected.9

VI. SOME CHALLENGES

(a) A 40% “SIN” SLAB — SIMPLIFICATION, OR A NEW LAYER OF COMPLEXITY?

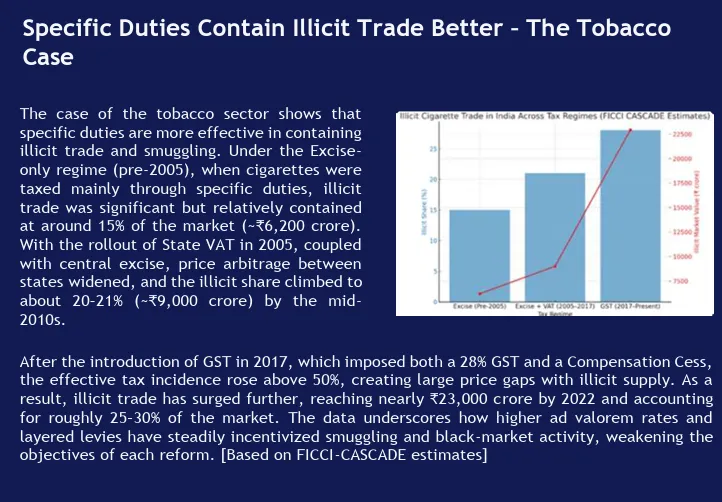

A headline 40% slab for “sin/luxury” goods risks being read as a third slab, potentially re-creating classification that simplification attempts to end. Where an ad valorem high rate is applied to heterogeneous categories (e.g., tobacco, SUVs, aerated beverages), it may blur key differences in illicit market risk (tobacco for example is a subject of high smuggling and illicit), elasticity, and social externalities. Uniform “high” rates can under- or over-tax sub-segments, prompting arbitrage and possibly grey-market growth—especially for high-smuggling products.23

(b) SPECIAL CESS / SPECIFIC DUTY NECESSARY – MAKE IT TRANSPARENT

A targeted specific duty/cess is often superior to a high ad-valorem rate for a few reasons: it recognizes product-specific risks, can be indexed and calibrated more precisely, and protects state revenues without unnecessarily distorting large swathes of the market. In practice India already relies on cess for tobacco (quantum-linked and ad valorem caps) and motor vehicles (differentiated by engine size/length/ground clearance). Acknowledging this openly—and codifying principles for its use— would improve predictability.24

(c) “CREATIVE” FIXES TO ARREST REVENUE DECLINE CAN BACKFIRE

Some ideas which have surfaced in the public debate that warrant caution:

i. Reclassification of Goods & Services: A quick way to raise revenue is by reclassifying more goods and services as “luxury” or “sin” items. Reports already highlight a proposed 40% slab for tobacco, pan masala, online gaming, and luxury vehicles. 4 The case of cement is telling: long taxed at 28% like a luxury item, it is now expected to move to 18% because of its mass impact. 22 These classification decisions directly shift both consumer burdens and government revenues.

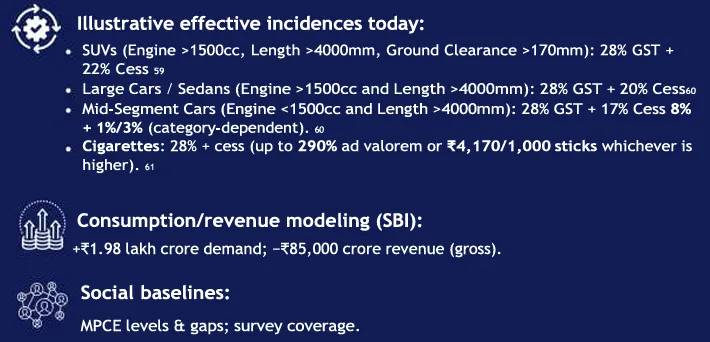

ii. Targeted Cess & Specific Duties: Even with promises of simplification, product-specific cess will remain. Tobacco already carries duties that push effective tax well above 100%25 while SUVs pay a 22% cess on top of 28% GST, clarified by a January 2023 circular 26 Such targeted cess provide stable revenue for states as the compensation cess sunsets in March 2026.5 But overreliance risks creating a de facto fourth slab.

iii. Narrowing the Mass Bucket: Even while promising that all food and textiles will move to 5%, the government could quietly restrict what qualifies, leaving some sub-segments at 18%. 21 Similarly, exemptions may be narrowed, so fewer goods actually benefit from the lower rate. This allows for a headline “Diwali gift” while containing fiscal costs—though it risks credibility and more disputes over fine-print classification.

iv. MRP-Based Valuation: Another idea floated in commentary is taxing on Maximum Retail Price (MRP) instead of transaction value. This would raise collections since discounts in garments or medicines would no longer lower the taxable base. MRP-based valuation was a feature of the old Central Excise regime for certain goods, and moving back to it would be a significant regression from the globally accepted “transaction value” principle that underpins a modern VAT/GST system. This clearly breaks with GST’s logic as a value-added tax: the law (Section 15 of the CGST Act) clearly pegs GST on transaction value. 27 Industry notes caution not to confuse MRP revision for passing on rate cuts with levying GST on MRP. 28

v. Expanding the High-Rate Basket with Micro Levies: Beyond the 40% slab, authorities could add micro-cess or surcharges on fast-growing sectors like high-end hospitality, or premium entertainment. 29 These are politically easier to tax and generate visible yield. But sweeping them all into one bucket risks confusion and can drive users toward grey or offshore alternatives.

vi. Nil GST on Insurance Without ITC: The GoM has proposed fully exempting life and health insurance premiums.30 On the surface, this looks like consumer relief. But if input tax credits (ITC) on commissions, reinsurance, and admin costs are denied, insurers’ costs rise and premiums go up. Analysts note a better compromise is 5% GST with ITC retention5, which balances affordability with neutrality.

VII. SOCIAL IMPACT OF DISTORTIONS

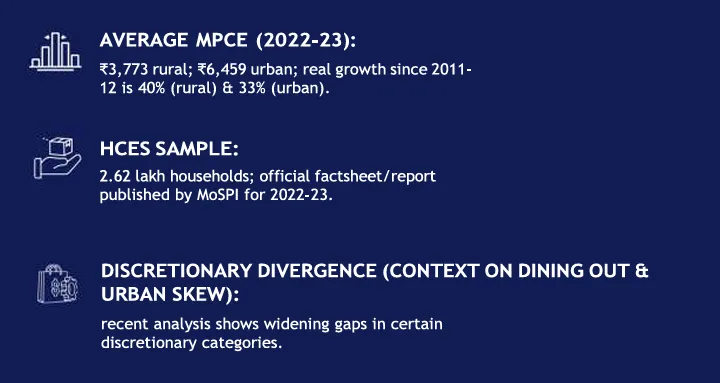

Tax policy shapes who consumes what, and when. If GST 2.0 reduces tax on mass-consumption goods but offsets it with across-the-board “high” rates on a broad set of “non-essentials,” it can inadvertently deepen a class divide: aspirational items remain out of reach for lower-income households, especially when discretionary spending is already diverging between urban and rural groups. Official consumption data (HCES 2022-23) show meaningful increases in average MPCE, but also persistent gaps between rural and urban consumption profiles. The reform must be careful not to harden these gaps. 31|32

A more surgical design—two slabs + specific cess for narrow categories—reduces the risk of one-size-fits-all “luxury” taxes that penalize diverse goods with very different elasticities and illicit-market profiles. Tobacco is not luxury cars; gaming is not liquor; aerated beverages are not cigarettes. Treating them as identical invites distortion and lowers the legitimacy of the system. 33

VIII. TOP 6 RECOMMENDATIONS

(a) Lock the architecture to three instruments—not three “slabs”: 5% (merit/essentials), 18% (standard), and a specific, transparent additional cess/duty for a narrow list of demerit/luxury goods.

A separate “40% slab” should be avoided. When a high tax incidence is needed, a specific additional duty/cess with clear rationale + indexation rules is better: it is transparent, predictable, and less distortionary than an undifferentiated “high” base slab. This also gives the Council room to tune for illicit-market risk (e.g., tobacco) vs. social externality (e.g., sugary drinks) vs. luxury signaling (e.g., super-luxury cars). 24|15

(b) Publish a “Cess Rulebook” with guardrails, indexation, and sunset checks.

Codify when a specific duty is used (e.g., smuggling risk, negative externality, luxury); how it is indexed (to inflation/quantity); how often it is reviewed; and how proceeds are shared to protect states post-compensation-cess era. Sunset reviews (every 24–36 months) should be mandatory, with data on revenue neutrality and market outcomes (licit vs. illicit share). 12

Clearly specify how this cess/ duty would be shared between centre and the states, to get the states on-board with the concept.

(c) No “backdoor” revenue devices.

While GST 2.0 seeks to simplify the rate structure, there is a risk that revenue shortfalls will be addressed through indirect or opaque tweaks. These “backdoor” devices should be resisted, or at the very least implemented with full transparency and safeguards:

i. 40% slab + cess

The proposed 40% sin slab undermines simplification. 4 If higher taxes are needed, use narrow, product-specific cess, not a blanket third slab.

ii. Narrowing the Mass Bucket

Shifting food and textiles to 5% GST risks being diluted if sub-segments are quietly kept at 18%. 21 Such fine print erodes credibility.

iii. MRP-based valuation

Taxing on MRP instead of transaction value would inflate collections and penalise discounts, breaking GST’s design. 27 Keep GST anchored to invoices.

iv. Micro levies

Adding surcharges on gaming, luxury hospitality, or entertainment may look attractive 29, but bundling diverse sectors into “sin” risks distortions and grey-market growth.

v. Nil GST on insurance without ITC

Exempting insurance but denying input tax credits raises premiums 5, A 5% rate with ITC is fairer and neutral.

(d) Use the reform to shrink litigation.

Alongside rate changes, issue binding classification notes for major sectors (autos, FMCG, pharma, F&B, e-commerce fees), consolidating past AAR/AAAR and Council clarifications (e.g., SUVs). Commit to a rolling “Compendium of Clarifications” with a 90-day SLA for ambiguous items. 15

(e) Targeted relief to mass consumption with strict revenue accounting.

If food/textiles migrate to 5%, pair that with a published, state-wise revenue backfill model (via cess proceeds or devolution adjustments). Transparently present projected consumption uplift vs. revenue impact, updated quarterly. 21

(f) Phase the roll-out and monitor.

Adopt a two-phase plan (Q3–Q4 FY26) with interim dashboards (refund times, ITC utilization, e-way bill compliance, price pass-through). Make the Council meeting calendar public, with agenda papers on rate migrations and impact notes. 7

IX. WAY FORWARD AND CONCLUSION

GST 2.0 can deliver a genuine leap if the simplification is real, not cosmetic. The path that best balances growth, equity, and federal finances is:

● Keep the core system at two slabs (5%/18%).

● Treat sin/luxury items via specific, transparent, indexed cess (not a broad “40% slab”).

● Publish a Cess Rulebook and a State Revenue Protection framework to replace the expiring compensation cess regime.

● Resist backdoor measures (Nil without ITC, MRP-based taxation) that look neat on paper but raise costs, complicate compliance, and undercut trust.

● Use phased roll-out with public dashboards, to ensure pass-through to consumers and timely course correction.

India’s macro environment—global tariff pressures on exports and a cautious China thaw—argues for a clean, growth-friendly GST that reduces friction for businesses, lowers prices for households, and assures states of a stable, predictable fiscal stream. The political economy will always tug at tax design; the test of GST 2.0 is whether design discipline can prevail. If it does, the reform will not just make goods cheaper; it will raise the credibility of India’s tax regime and anchor the next leg of consumption-led growth. 9

REFRENCES

1. Modi’s tax overhaul to strain finances but boost image amid US trade tensions | Reuters

2. Next-gen GST set to be ‘game changer’, paves way for single tax slab by 2047: Govt sources – The Economic Times

3. Anticipating GST changes, Ludhiana industry wants reforms expedited. | Ludhiana News – Times of India

4. GST reforms: Govt mulls 5% slab for common man items; Luxury , sin goods to face 40% tax – The Economic Times

5. India government has not quantified loss to exchequer due to tax cuts, says state minister | Reuters

6. India plans sweeping consumption tax cuts by October to boost economy | Reuters

7. India’s GST council to meet on September 3-4 to discuss sweeping tax cuts | Reuters

8. GST rate rejig to give Rs 1.98 lakh cr consumption boost, yearly revenue loss seen at Rs 85,000 cr: Report – The Economic Times

9. Steep US tariffs set to hit Indian exports from Wednesday | Reuters

10. 01072018-GST-Concept-Status.pdf

11. https://cbic-gst.gov.in/pdf/compnsation-cess-circular1.pdf

12. https://www.cochinchamber.org/storage/circulars/July2022/IXLN3DNSZpgS0gv4Vcw0.pdf

13. https://cbic-gst.gov.in/pdf/01072018-GST-Concept-Status

14. India’s complex GST tax and how Modi’s reform will make goods cheaper | Reuters

15. https://gst.kar.nic.in/Documents/General/cir189cgst16123.pdf

16. https://www.companiesinn.com/articles/gst-revised-cess-rates-tobacco-pan-masala

17. https://www.reuters.com/world/india/indias-gst-council-meet-september-3-4-discuss-sweeping-tax-cuts-2025-08-22/

18. https://sbi.co.in/documents/13958/14472/GST%2B2.0_SBI%2BResearch.pdf/1edb0d41-f5d7-fabf-6ee9-7731b8f17d08?t=1755607191262

19. Full GST exemption on health and life insurance premiums proposed: While insurers may hike premium, post tax cost for consumer is likely to come down – The Economic Times

20. Will life, health insurance premiums become cheaper with zero GST proposal? – India Today

21. All food and textile items may be moved into 5% GST slab – Times of India

22. GST cut: Major plan on agenda for all food, textile items – The Economic Times

23. India proposes slashing taxes on small cars under Modi reforms, sending shares higher | Reuters

24. GST Council Unveils Revised Cess Rates for Tobacco and Pan Masala Products

25. What are sin goods? List of items to face 40% tax under GST 2.0

26.https://timesofindia.indiatimes.com/business/india-business/gst-council-to-consider-levy -of-22-suv-cess-at-its-next- meeting/articleshow/96347838.cms

27. GST 2.0 is here—4 immediate steps businesses can’t afford to miss – The Economic Times

28. www.jarapp.net

29. GST 2.0 tussle: Centre eyes extra duty over 40% slab on tobacco products; states push for ‘significant’ cut – Times of India

30. https://www.indiatoday .in/business/personal-finance/story /gst-on-life-and-health-insurance-may -soon-be-exempt-what-it-means-for-you-2774508- 2025-08-21

31. Press Release:Press Information Bureau

32. https://www.mospi.gov.in/sites/default/files/press_release/Version_2_press_note_hces2022-23_24022024.pdf

33. India’s complex GST tax and how Modi’s reform will make goods cheaper | Reuters

34. Press Information Bureau

35. https://www.mospi.gov.in/sites/default/files/publication_reports/Factsheet_HCES_2022-23.pdf

36. Eating Out: What MoSPI’s Nutrition Survey Reveals About UrbanRural Gaps – FACTLY

37. https://www.gstcouncil.gov.in/sites/default/files/2024-02/gst-ready -reckoner-cgst-01052022.pdf

38. https://www.pib.gov.in/PressReleasePage.aspx?PRID=2026672

Nilanjan Banik is a professor of finance and economics at the School of Management, Mahindra University.

The article was first published in Think Forum as GST 2.0 – Two slabs today, One rate tomorrow on September 1, 2025.

Disclaimer: All views expressed in the article belong solely to the author and not necessarily to the organisation.

Read more at IMPRI:

Palayan Politics in Bihar: Overlooked Economic Realities

Democratic and Inclusive Universities: A Sign of Progress

Acknowledgment: This article was posted by Srishti, a research intern at IMPRI.