Policy Update

Bhavana Girase

Background

India’s agricultural sector is the backbone of the national economy. In FY 2023-24, it contributed 17.7% to the country’s Gross Value Added (GVA) and employed nearly half the nation’s working population. With 54.8% of its 328.7 million hectares of land cultivated and a cropping intensity of 155.4%, agriculture is not just about food production; it is essential for millions and a driving force for rural development.

Despite having such a large contribution to the economy, Indian farmers continue to struggle, particularly after the harvest season. Unpredictable monsoons, changing market prices, and limited access to institutional credit often leave them with little choice but to sell their produce quickly, even at low prices.

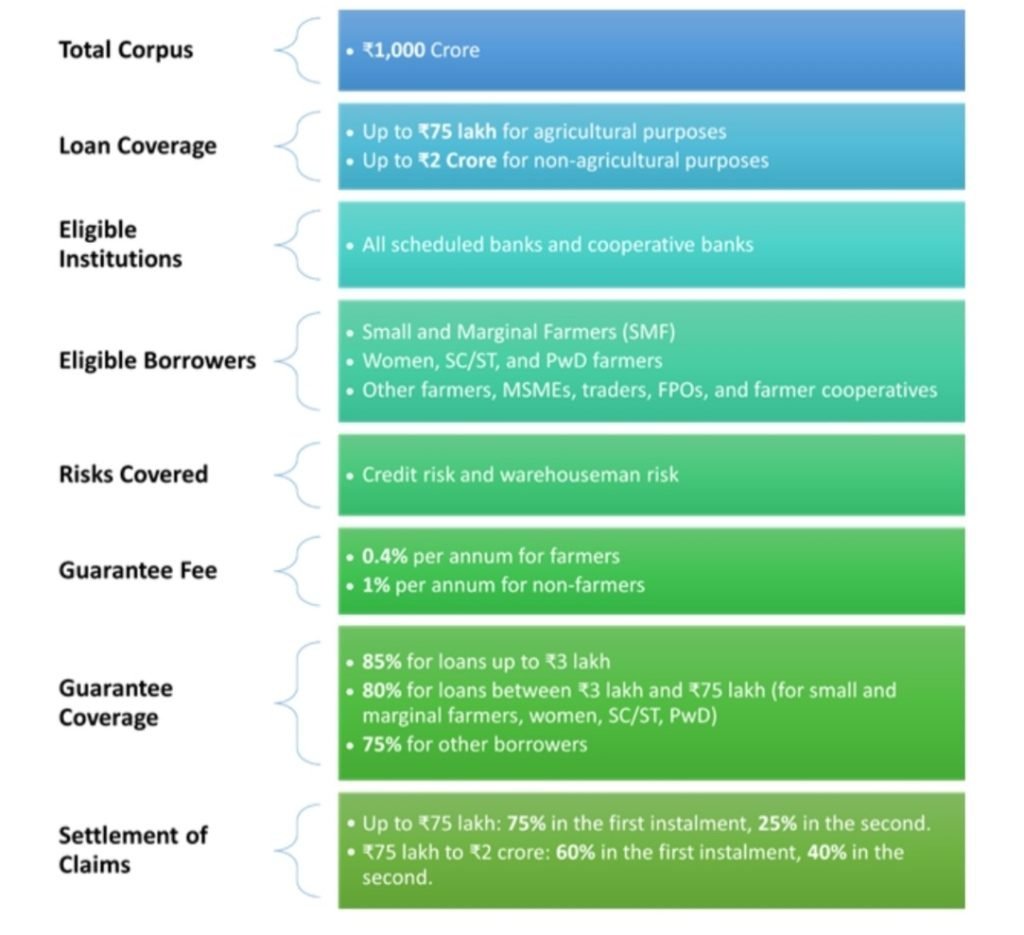

In order to overcome these challenges, the Government of India launched the Credit Guarantee Scheme for e-NWR Based Pledge Financing (CGS-NPF) on 16 December 2024. Budgeted at ₹1,000 crore, this Central Sector Scheme is managed by the Department of Food and Public Distribution (DFPD). It is set to operate from FY 2024-25 until the end of the 16th Finance Commission cycle in 2030-31.

Through the scheme, farmers can secure loans by using their produce as collateral, stored in warehouses registered by WDRA. They use electronic negotiable warehouse receipts (e-NWRs). These digital documents make the entire process more transparent, trustworthy, accessible, and more affordable.

Functioning

Source: Press Information Bureau(PIB) https://www.pib.gov.in/PressReleasePage.aspx?PRID=2086154

The CGS-NPF scheme is designed to fill the gap between harvest and sale by giving financial support when farmers need it most. The process is as follows:

1. Farmers store their produce in WDRA-accredited warehouses, which then issue e-NWRs through registered repositories like NERL or CCRL. This simple digital chain makes credit faster and more transparent.

2. Farmers can then use these e-NWRs as collateral to approach banks or other financial institutions for loans.

Benefits of the e-NWR Scheme:

1. The scheme’s credit guarantee encourages banks to lend confidently to farmers.

2.This not only strengthens farmers bargaining power but also encourages better storage practices, reducing post-harvest losses and enhancing income.

3. The scheme benefits small and marginal farmers, women, SC/ST and Divyangjan (PwD) farmers. It also benefits MSMEs, Farmer Producer Organisations (FPOs) and traders.

Key financial features include:

- Small and marginal farmers receive 80-85% guarantee coverage for loans up to ₹75 lakh.

- Up to ₹2 crore loans for MSMEs, FPOs, and traders are guaranteed up to 75%.

- A low guarantee fee keeps the scheme affordable for grassroots stakeholders.

Performance

The scheme builds on the success of the Warehousing Development and Regulatory Authority (WDRA) in the warehousing sector. Over the past year, WDRA has seen a 150% increase in warehouse registrations, accrediting 1,522 new facilities and bringing the total to over 4,800 warehouses.

The scheme has notably improved the flow of agricultural credit:

- During FY 2022-23, pledge finance against e-NWRs crossed ₹2,442 crore, a growth of 64% increase over the previous year.

- Banks such as SBI and PNB have entered into agreements with WDRA to provide priority sector loans to e-NWR holders.

WDRA has taken a number of steps to reduce entry barriers:

- Waiving registration and renewal fees for two years.

- Lowering the net worth requirements for warehouse operators.

- Allowing entities with negative net worth (established under Acts of Parliament or State Legislatures) to register via indemnity bonds.

- Covered warehouse inspection costs to reduce operational barriers.

Outreach has grown with 12 MoUs signed with agricultural universities and workshops held with commercial and regional rural banks to raise awareness and build capacity.

Impacts

The CGS-NPF scheme is expected to transform India’s agricultural finance. Its effects are clear in several areas:

1. Reduced Distress Sales: By offering credit immediately after harvest, farmers are no longer forced to sell at from having to sell immediately, allowing them to wait for better market prices.

2. Improved Liquidity: Farmers can obtain working capital immediately without sacrificing ownership over their produce.

3. Strengthened Rural Credit Ecosystem: Banks are more confident through government-backed guarantees and hence are more willing to finance post-harvest storage.

4. Scientific Storage Practices: The scheme encourages the use of regulated warehouses, leading to improved storage standards such as pest management, control of moisture, and stock handling practices.

5. Inclusive Growth: Focusing on small and marginal farmers, women, and other weaker sections, the scheme helps bridge rural financial inequality.

6. Boost to Warehousing Sector: Both private and public players are now more motivated to build new warehouses, especially closer to farms. This supports the goal of modernising agri-logistics.

Emerging Issues

Despite initial success, several challenges need to be addressed:

- Non-Mandatory Registration: Currently, only warehouses that issue e-NWRs are required to register with WDRA.

- Limited Warehouse Reach: Registered warehouses are still scarce in several rural and remote areas.Many remote areas still lack warehouses because of high setup cost, poor rural infrastructure and low private investment.

- Low Awareness: Awareness of e-NWRs and their benefits remains low among farmers. Inadequate outreach, digital illiteracy and lack of localized training prevent farmers from understanding and using e-NWRs.

- High Repository Charges: Fees charged by NERL and CCRL are a burden for smallholders.

- Digital Gaps: The true potential of the scheme is possible only when farmers, warehouse operators, banks, and repositories are digitally connected through efficient platforms.

Way Forward

To unlock the full potential of CGS-NPF and support the government’s vision of doubling farmers’ incomes, India must take the following steps:

1. Make WDRA Registration Compulsory: State governments and public sector bodies should follow the example of FCI and MPWLC, which only use registered warehouses.

2. Increasing Infrastructure: Achieving the target of registering 40,000 warehouses within the next 1–2 years must be made a national priority.

3. Farmer-Focused Awareness Campaigns: Use Common Service Centres (CSCs), agricultural extension workers, and rural banks to educate farmers about the e-NWR process and its benefits in local language.

4. Introduce a Unified Digital Gateway: This platform should bring together banks, repositories, warehouse operators, and farmers, simplifying the lending process.

5. Interlink KCC with Pledge Finance: Connecting Kisan Credit Cards (KCC) with e-NWR financing will lower interest costs and improve repayment cycles.

6. Lower Repository Charges: Reduce the cost of repository services, particularly for FPOs and smallholders farmers, to promote increased adoption.

Conclusion

The Credit Guarantee Scheme for e-NWR Based Pledge Financing (CGS-NPF) is a big move toward addressing key challenges in post-harvest agriculture. By linking digital tools with improved storage and government support, the scheme offers farmers a more reliable way to access credit. By promoting inclusivity, transparency, and economic growth, the scheme supports the broader vision of Aatmanirbhar Bharat by helping small farmers gain better control over their produce and income. If well implemented and supported by ongoing policy reforms, CGS-NPF could help farmers play a more active role in the agriculture market, beyond just growing crops.

References

1. Press Information Bureau. (2024). Union Food and Consumer Affairs Minister launches Credit Guarantee Scheme for e‑NWR based pledge Financing (CGS‑NPF). https://www.pib.gov.in/PressReleasePage.aspx?PRID=2085018

2. Press Information Bureau. (2024). Strengthening Agricultural Finance and Welfare. https://www.pib.gov.in/PressReleasePage.aspx?PRID=2086154

3. Warehousing Development & Regulatory Authority (WDRA). https://wdra.gov.in/web/wdra/faq-cgs

4. Press Information Bureau. (2023). WDRA organizes a one day conference on e‑NWR. https://www.pib.gov.in/PressReleaseIframePage.aspx?PRID=1950221

5. Press Information Bureau. National Farmers Day. https://www.pib.gov.in/PressNoteDetails.aspx?NoteId=153592&ModuleId=3

6. Press Information Bureau. https://www.pib.gov.in/PressReleaseIframePage.aspx?PRID=1973924

About the Contributor

Bhavana Girase is a Research Intern at the Impact and Policy Research Institute (IMPRI). A data and policy research enthusiast, with a background in UPSC preparation and focusing on turning complex data into interpretative insights for a better understanding of policies.

Acknowledgement

The author sincerely thanks Ms. Aasthaba Jadeja and the IMPRI team for their valuable support and guidance.

Disclaimer

All views expressed in the article belong solely to the author and not necessarily to the organisation.

Read More at IMPRI

Ishan Uday Special Scholarship Scheme for North East Region (2014): A Policy Analysis